Technology has come a long way and BPI is not just riding this trend but has actually been making sure that they are future-ready by launching the all-new BPI app.

The Bank of the Philippine Islands (BPI) launched a totally new and future-ready mobile app with innovative features and services that go beyond convenient transactions and help more Filipinos work their way towards financial well-being. This reinforces the bank's solid footing as a digital banking leader in the country.

"We're proud of the new BPI app, and we know there's room to continue improving. While we look at the best technology and digital solutions to ensure that we deliver excellent service, we anchor the designed experiences to what our customers need," explained Jose Teodoro 'TG' Limcaoco, BPI President and CEO.

"Our customers have the option to bank with the app in tandem with BPI branches and ATMs- giving them a choice of their preferred channel with integrated services like online booking of branch visits or cashless withdrawal," said Ginbee Go, BPI EVP & Consumer Banking Head.

The new app goes beyond everyday transactions and helps build towards Filipinos' financial independence. "This boasts of a new design and experience, and we look forward to exciting new features that you won't find in the older BPI Mobile app like mobile check deposit, AI-powered insights on your savings and spending, and more. These are core retail products designed not just to be convenient and sustainable but also customer-centric even in the long-term," said Mariana Zobel de Ayala, BPI Consumer Bank Marketing, Platforms, & Digital Activation Head.

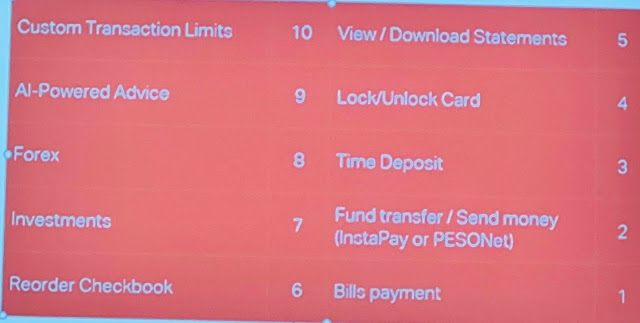

The new BPI app highlights the following features:

Improved User Experience- users can get things done in fewer taps, with top transactions that are easier to access upon login and faster to finish. Help links are now found within transaction processes for easier access to guides and FAQs.

Online Account Opening- new clients can open a BPI #SaveUp account on the app within five minutes with just one ID. They can instantly start banking via the app.

Personal Finance Management (Coming in May)- BPI will be the first bank app to feature AI-powered tracking and insights. The app will offer financial advice, payment reminders, and actionable tips to help millions of Filipinos improve their financial wellness.

Aside from those features, there will also be a mobile check deposit, real-time bill payment, cash withdrawal via QR, save favorite transactions, and other product applications.

BPI Consumer Platforms Head Fitzgerald Chee pointed out that BPI Mobile app users do not have to delete their old app yet. "You can continue to log in the older BPI Mobile app with your current username and password. Users that want to start enjoying the new BPI app can find easy-to-follow guides on our FB page and YT channels. You can also view all your personalized settings, previous transactions, and statements right away on the new BPI app. For your security, the Mobile Key works within the new BPI app or the older app. Users can choose which app version to activate their Mobile Key."

"Customers are looking for banks that can serve them well," added Limcaoco. "We assure our clients that BPI will continue to constantly change with the times to meet their evolving needs."

Thew all-new and future-ready BPI App is now available for download on the App Store and on Google Play.

0 comments:

Post a Comment